jBreakoutTrader

Automated Price Range Breakout Trading with Interactive Brokers

About

jBreakoutTrader trades price range breakouts. It can be used to trade opening range breakouts

or breakouts happening at other times of the day (example: breakouts at scheduled economic reports).

jBreakoutTrader automatically places the entry order, the stop loss order, the target limit order

and a market-on-close order. Configuration parameters for the breakout strategy are read from a text file.

jBreakoutTrader works on Windows, Mac and Linux.

Strategy

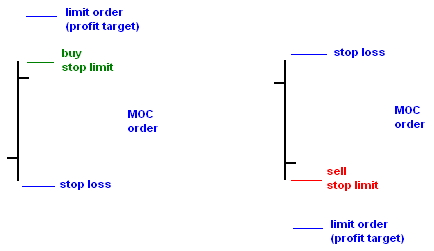

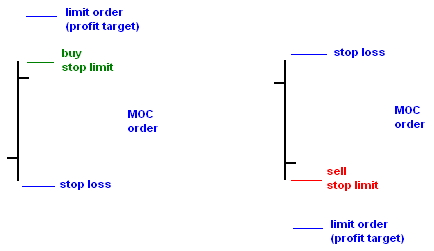

When the trigger bar is completed, jBreakoutTrader looks for breakouts above the high price

(buy breakouts) or for breakouts below the low price (sell breakouts)

and it will place a buy/sell stop limit order depending on the direction of the breakout.

The stop price of the stop limit entry order is the high or low of the trigger bar;

the limit price is at a configurable distance from the stop price (examples: for buy breakouts, if stop price is 10

the limit price could be 10.02; for sell breakouts: if stop price is 15 the limit price could be 14.95).

The breakout entry order has attached a bracket order set (for profit taking and loss protection) and an optional market-on-close order

(to avoid carrying the position overnight in case the position was not already closed by the bracket order).

The profit taking order is a limit order.

The profit taking order is placed at a configurable distance from the breakout price.

The stop loss order is a stop order.

The stop loss order price is placed at a configurable distance from the low price for buy breakouts

(example: 0.03 lower than the low price) or from the high price for sell breakouts (example: 0.05 higher than the high price).

The purpose of the optional Market-On-Close order is to be executed only at the close of the regular

trading session, if neither the profit taking order nor the stop loss orders were triggered, to avoid carrying the position overnight.

The strategy keeps a One-Cancels-All association between breakout order, target profit order, stop loss order and MOC order.

Features

- configurable time interval duration

- configurable start time for the time interval

- breakout stop limit entry order with configurable limit price parameter (distance to the stop price)

- attached stop loss order, profit target limit order and optional MOC order for automatic trade management

- configurable stop loss price function of the price range high/low

- configurable target limit order function of the breakout price

- all orders of the breakout strategy are OCA (One-Cancels-All)

- can place trades for several contracts/symbols with different breakout parameters

- ability to take only buy breakouts, only sell breakouts or both

- only one set of orders will be created during the whole trading session, but if the first time interval did not create a breakout, jBreakoutTrader will monitor the next time interval until a breakout happens.

- configure if the orders are automatically sent to the exchange or just created on Trader Workstation

- supported contracts: stocks, futures, etc...

Agreement

By purchasing the software you agree to use it for personal purposes only

(to negotiate a different license contact me).

You cannot transfer, rent, lease, lend, copy, share the software and/or documentation.

You cannot adapt nor change the software and you cannot re-sell the software.

You may not reproduce or distribute any documentation without my permission.

You may install a copy of the software on a computer and freely move the software

from one computer to another, provided that you are the only individual using the software.

In no event shall I be liable for any special, incidental, indirect, or consequential damages whatsoever

(including, without limitation, damages for loss of business profits, business interruption, loss of

business information, or any other pecuniary loss) arising out of the use of or inability to use the

software product or the provision of or failure to provide support services.

Contact

Click to Buy

Free 7-day Evaluation

Forward this to someone.

Questions ? Use the Contact form.

Interactive Brokers (IB) is a low cost provider of trade execution and clearing services for individuals, advisors, prop trading groups, brokers and hedge funds. IB's premier technology provides direct access to stocks, options, futures, forex, bonds and funds on over 100 markets worldwide from a single IB Universal account.

Member NYSE, FINRA, SIPC. Visit www.interactivebrokers.com for more information.

Copyright © 2012-2025 Trading Software Lab. All rights reserved.