jOpenTrader

Automated stock trading with Interactive Brokers

About

jOpenTrader is a tool that places

NYSE and NASDAQ buy/sell orders on market open (via SMART routing) with protective

stop loss orders and profit limit orders. Working parameters are read

from an input text file.

jOpenTrader works on Windows, Mac and Linux.

Features

jOpenTrader must be started before market opens. It waits for the US stock market open

and then it starts to compute the open price (or the open price range) for the stocks listed

in the input text file.

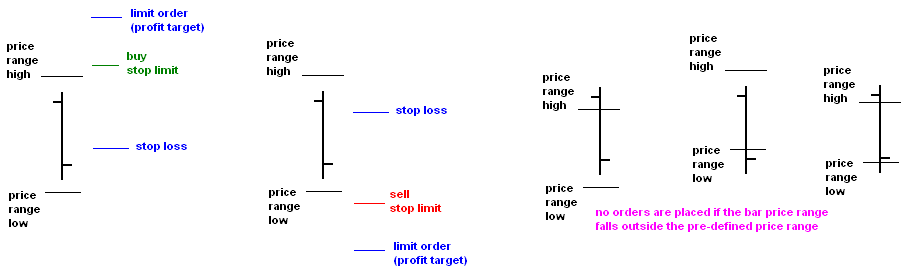

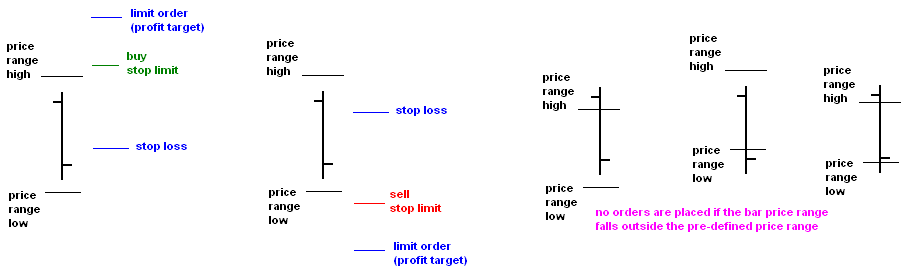

If the opening price range falls inside the specified price range filter, the buy/sell order

and the associated bracket order are sent to the exchange (or else it will only be transmitted

to the Trader Workstation).

The time interval for open price range computation is configurable as are:

stock symbols, the number of shares,

the buy/sell flag, the price range filter, the stop limit price to enter the market,

the protective stop loss, the profit target,

the number of seconds for the open price range computation and the flag that

determines if the orders are sent to the exchange or only to the TWS.

Illustration

Example

Here's an example input configuration file:

Ticker Cant B/S R1 R2 SL-STP SL-LIM STP LMT Secs Send

OMTR 800 B 26.15 26.25 26.18 26.2 25.52 27.35 300 1

OMTR 800 B 24.2 25.5 24.5 25.4 24 26.2 300 1

GAS 400 S 40.7 40.67 40.7 40.67 41.56 40.22 300 1

MSFT 100 B 35.0 34.0 35.00 35.05 34.00 36.00 600 0

IBM 100 B 105.00 104.00 107.00 107.10 106.00 108.00 600 0

SPY 100 S 140.00 151.00 150.50 150.25 151.00 149.00 600 0

GOOG 1 S 645.00 660.00 630.25 630.00 632.00 628.00 0 0

Each line lists: the stock symbol, the number of shares, the buy/sell flag,

the high and low of the price range filter, the stop price and the limit price of the

stop limit order, the stop loss price, the target limit price,

the number of seconds for opening range price computation and the send flag.

The first line of the file (after the header) is instructing

jOpenTrader to buy 800 shares of OMTR after market open with a stop limit of 26.18-26.2,

a stop loss of 25.52 and a profit target of 27.35 if the 300 seconds opening price range

falls inside 26.15-26.25. If this condition is verified the orders are sent to the exchange

or else they are only transmitted to the TWS.

Requirements

- an account with Interactive Brokers with at least one market data subscription

- Trader Workstation installed and correctly configured.

Agreement

By purchasing the software you agree to use it for personal purposes only

(to negotiate a different license contact me).

You cannot transfer, rent, lease, lend, copy, share the software and/or documentation.

You cannot adapt nor change the software and you cannot re-sell the software.

You may not reproduce or distribute any documentation without my permission.

You may install a copy of the software on a computer and freely move the software

from one computer to another, provided that you are the only individual using the software.

In no event shall I be liable for any special, incidental, indirect, or consequential damages whatsoever

(including, without limitation, damages for loss of business profits, business interruption, loss of

business information, or any other pecuniary loss) arising out of the use of or inability to use the

software product or the provision of or failure to provide support services.

Contact

Click to Buy

Free 7-day Evaluation

Forward this to someone.

Questions ? Use the Contact form.

Interactive Brokers (IB) is a low cost provider of trade execution and clearing services for individuals, advisors, prop trading groups, brokers and hedge funds. IB's premier technology provides direct access to stocks, options, futures, forex, bonds and funds on over 100 markets worldwide from a single IB Universal account.

Member NYSE, FINRA, SIPC. Visit www.interactivebrokers.com for more information.

Copyright © 2007-2025 Trading Software Lab. All rights reserved.